Part I. Intramarket Correlations

Commander in Pips: Once we’ve discussed different relations between the forex market and other markets – such as financial and commodity markets, but I want to make small add-on. Still, there is a relation inside forex market itself – of one pair to another. That’s the topic that I intend to show you for further discussion. We call it as Intramarket correlation, while the previous one was Intermarket correlations and relations…

Commander in Pips: That’s right. By that observation we could say that there is some relation between currencies that exists. Even more, since currencies trade in pairs – if we speak about Forex and not about, say, the Dollar Index, then they just can’t be totally isolated from each other. For measurement of the strength of relation there are different statistical coefficients that exist and one of the most popular is correlation. This coefficient will show the strength of relation between different pairs.

Commander in Pips: Mostly because this is quite important if you trade multiple pairs on your account. If you focus on some particular pair – this might be not so significant to you. But if you trade many pairs and do not know how they relate to each other – it’s a wash out. If some pairs have a solid relation and move together – this can significantly increases your risk if you trade both of them. So, the major application of correlation coefficient is risk management sphere.

Pipruit: I see. And how it works, your correlation stat?

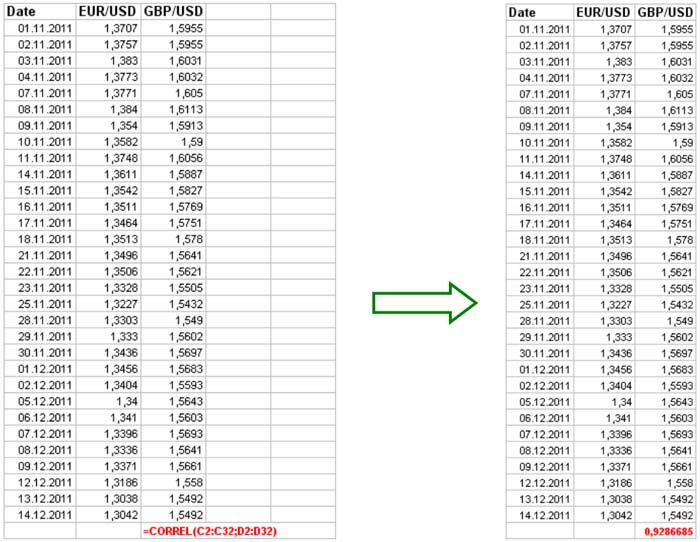

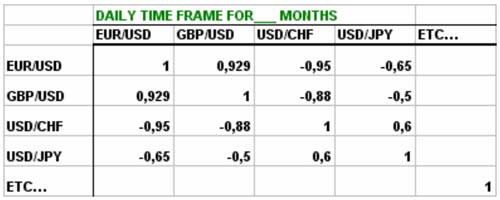

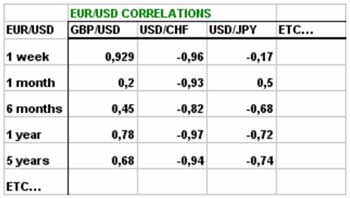

Here is first example – when correlation table (or matrix) was created for the same period of analysis (say, 3 months), quotes of all pairs were daily. So, on crossing of any column and row we see corresponding Correlation. For example on crossing EUR/USD and GBP/USD we see our number of 0.9286.

Pipruit: And why EUR/USD to EUR/USD correlation is 1? And for other repeated pairs? Why EUR-USD correlation equals to GBP-USD correlation?

Pipruit: Ok, I see. The major thing that I have to note is that high numbers of correlation tells that pairs mostly move in the same direction while negative number close to -1 tells that they move equal but in counter directions. If correlation is close to zero – then there is an absence of any relation and pairs move independently.

Pipruit: Hm… Really. How we can use it?

Commander in Pips: Ok, let’s turn to some examples:

Commander in Pips: Well, with our simplified understanding this will give you just 0.07 lot in EUR/USD, or we can round it to zero – but this position has no sense. But, you should not invent the bicycle here – just enter long with EUR/GBP, if you want. Second, since correlation of these pairs is significant, their volatility might be different – and you probably will end your trade with some small loss or profit. Still this trade looks doubtful. You will not be able to predict corresponding moves of these pairs. One way how correlation has to be used here – is for understanding that your risk will double and adjust your trading lot accordingly if you still want to enter the same direction with EUR as with GBP – to match your risk management system.

Pipruit: Probably you’re right, I understand. Enter with 2 lots of EUR/USD – will be almost the same… or with 2 lots of GBP/USD.

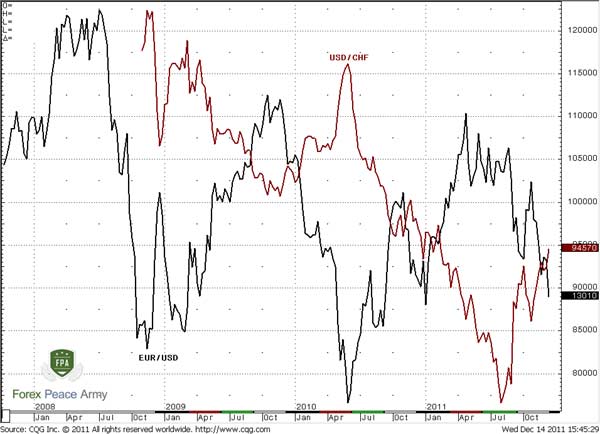

Pipruit: Wait a minute, let me guess. If we will take highly negatively correlated pairs – for example EUR/USD and USD/CHF and take opposite positions with them – look chart below… This will be the same as taking one direction positions on positively highly correlated pairs, right? So enter long with EUR/USD and simultaneously short USD/CHF will give us the same as enter long EUR/USD and GBP/USD or enter with twice the size long on EUR/USD?

Comments

Table of Contents

- Introduction

- FOREX - What is it ?

- Why FOREX?

- The structure of the FOREX market

- Trading sessions

- Where does the money come from in FOREX?

- Different types of market analysis

- Chart types

- Support and Resistance

-

Candlesticks – what are they?

- Part I. Candlesticks – what are they?

- Part II. How to interpret different candlesticks?

- Part III. Simple but fundamental and important patterns

- Part IV. Single Candlestick Patterns

- Part V. Double Deuce – dual candlestick patterns

- Part VI. Triple candlestick patterns

- Part VII - Summary: Japanese Candlesticks and Patterns Sheet

-

Mysterious Fibonacci

- Part I. Mysterious Fibonacci

- Part II. Fibonacci Retracement

- Part III. Advanced talks on Fibonacci Retracement

- Part IV. Sometimes Mr. Fibonacci could fail...really

- Part V. Combination of Fibonacci levels with other lines

- Part VI. Combination of Fibonacci levels with candle patterns

- Part VII. Fibonacci Extensions

- Part VIII. Advanced view on Fibonacci Extensions

- Part IX. Using Fibonacci for placing orders

- Part X. Fibonacci Summary

-

Introduction to Moving Averages

- Part I. Introduction to Moving Averages

- Part II. Simple Moving Average

- Part III. Exponential Moving Average

- Part IV. Which one is better – EMA or SMA?

- Part V. Using Moving Averages. Displaced MA

- Part VI. Trading moving averages crossover

- Part VII. Dynamic support and resistance

- Part VIII. Summary of Moving Averages

-

Bollinger Bands

- Part I. Bollinger Bands

- Part II. Moving Average Convergence Divergence - MACD

- Part III. Parabolic SAR - Stop And Reversal

- Part IV. Stochastic

- Part V. Relative Strength Index

- Part VI. Detrended Oscillator and Momentum Indicator

- Part VII. Average Directional Move Index – ADX

- Part VIII. Indicators: Tightening All Together

- Leading and Lagging Indicators

- Basic chart patterns

- Pivot points – description and calculation

- Elliot Wave Theory

- Intro to Harmonic Patterns

- Divergence Intro

- Harmonic Approach to Recognizing a Trend Day

- Intro to Breakouts and Fakeouts

- Again about Fundamental Analysis

- Cross Pair – What the Beast is That?

- Multiple Time Frame Intro

- Market Sentiment and COT report

- Dealing with the News

- Let's Start with Carry

- Let’s Meet with Dollar Index

- Intermarket Analysis - Commodities

- Trading Plan Framework – Common Thoughts

- A Bit More About Personality

- Mechanical Trading System Intro

- Tracking Your Performance

- Risk Management Framework

- A Bit More About Leverage

- Why Do We Need Stop-Loss Orders?

- Scaling of Position

- Intramarket Correlations

- Some Talk About Brokers

- Forex Scam - Money Managers

- Graduation!