Part IV. Sentimental analysis

Commander in Pips: Sentimental analysis is a bit more delicate substance than Technical and Fundamental analysis. Although technical analysis tells us that “price includes all available information” and that price is all trader’s need to make a deal decision – things are not so simple. We will not debate now on does price really reflect all available information or not – let’s assume that it does, but this point doesn’t mean that all traders open positions in the same direction. Of cause every trader sees the direction of the market, but almost everyone has its own explanation why does market move particularly this way.

But take a look at this moment from different side – maybe the market moves in this particular way (up or down), because it just mirrors what all traders think about it. Each trader opens positions according to his or her own thoughts and opinions about the market, and, it fact, all these positions create that substance that we call market sentiment.

Pipruit: Hm, it sounds like talks from another world. What is the practical application of this stuff?

Commander in Pips: Well, it’s very simple. For example, you are extremely bullish on some currency, say, EUR, but the market has a bearish sentiment – then the market will go down, and you can do nothing here. It’s a pity, but it’s true.

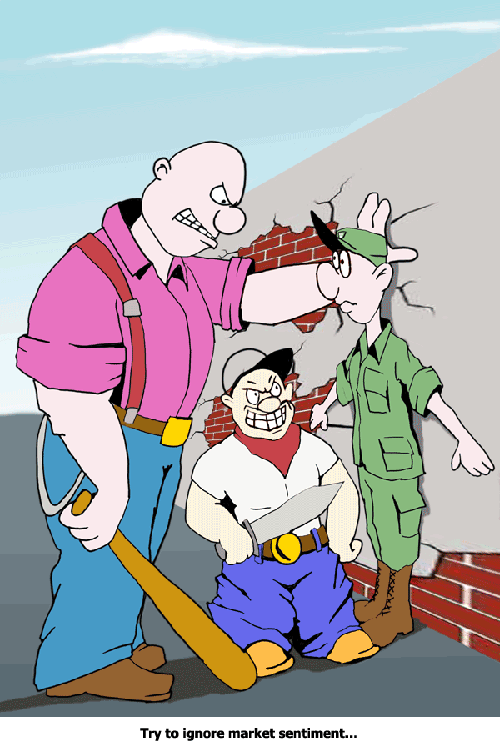

And there is a simple conclusion to us – you can’t for any reason ignore the market sentiment and have to take it into account and include it somehow in your trading strategy. If you will not do that – it will cost you money.

Later we will discuss how to analyze market sentiment so you can use it in your own favor.

Comments

S

syncopat

12 years ago,

Registered user

How do you differentiate between the cultural bias in the marketplace. For instance, I live in North America (Canada) and many of us see the EUR/USD different than Europeans, so how do I know what the true sentiment is or likely will be?

Sive Morten

12 years ago,

Registered user

> How do you differentiate between the cultural bias in the marketplace. For instance, I live in North America (Canada) and many of us see the EUR/USD different than Europeans, so how do I know what the..

Hi Syncopat,

Fundamentals could not be different. That's obvious. Hence, the difference in chart looking. Here, I suggest you to re-read chapter where spot market compare to futures market. Here we've talked about this problem. The point is that although you can see charts different from EU, for instance, futures charts look absolutely identically despite the fact where you are living in.

The same is with other sentiment issues, such as trading volume and open interest - futures show overall market, while your local spot broker/dealer only it's own volume, and may be the volume of it's above broker.

I hope, that I've understand you right. If not - please specify your question with necessary details.

Thanks.

Hi Syncopat,

Fundamentals could not be different. That's obvious. Hence, the difference in chart looking. Here, I suggest you to re-read chapter where spot market compare to futures market. Here we've talked about this problem. The point is that although you can see charts different from EU, for instance, futures charts look absolutely identically despite the fact where you are living in.

The same is with other sentiment issues, such as trading volume and open interest - futures show overall market, while your local spot broker/dealer only it's own volume, and may be the volume of it's above broker.

I hope, that I've understand you right. If not - please specify your question with necessary details.

Thanks.

M

Mahmoud Aladdin

12 years ago,

Registered user

Sentiment analysis

Dear Commander

When will you post the Sentiment analysis methodology? I read about it for Jamie Seatle from FXCM but it is subjective, i need simple way like the one you provide

Mainly i depend in COT but it is delayed version

Mahmoud

Dear Commander

When will you post the Sentiment analysis methodology? I read about it for Jamie Seatle from FXCM but it is subjective, i need simple way like the one you provide

Mainly i depend in COT but it is delayed version

Mahmoud

Sive Morten

12 years ago,

Registered user

> Dear Commander

When will you post the Sentiment analysis methodology? I read about it for Jamie Seatle from FXCM but it is subjective, i need simple way like the one you provide

Mainly i depend ..

Mahmoud,

Sentiment analysis mostly subjective. There will be seperate chapter dedicated to it, but not very soon.

In general, you stand on the right way - COT data is a major source of information for it.

When will you post the Sentiment analysis methodology? I read about it for Jamie Seatle from FXCM but it is subjective, i need simple way like the one you provide

Mainly i depend ..

Mahmoud,

Sentiment analysis mostly subjective. There will be seperate chapter dedicated to it, but not very soon.

In general, you stand on the right way - COT data is a major source of information for it.

Table of Contents

- Introduction

- FOREX - What is it ?

- Why FOREX?

- The structure of the FOREX market

- Trading sessions

- Where does the money come from in FOREX?

- Different types of market analysis

- Chart types

- Support and Resistance

-

Candlesticks – what are they?

- Part I. Candlesticks – what are they?

- Part II. How to interpret different candlesticks?

- Part III. Simple but fundamental and important patterns

- Part IV. Single Candlestick Patterns

- Part V. Double Deuce – dual candlestick patterns

- Part VI. Triple candlestick patterns

- Part VII - Summary: Japanese Candlesticks and Patterns Sheet

-

Mysterious Fibonacci

- Part I. Mysterious Fibonacci

- Part II. Fibonacci Retracement

- Part III. Advanced talks on Fibonacci Retracement

- Part IV. Sometimes Mr. Fibonacci could fail...really

- Part V. Combination of Fibonacci levels with other lines

- Part VI. Combination of Fibonacci levels with candle patterns

- Part VII. Fibonacci Extensions

- Part VIII. Advanced view on Fibonacci Extensions

- Part IX. Using Fibonacci for placing orders

- Part X. Fibonacci Summary

-

Introduction to Moving Averages

- Part I. Introduction to Moving Averages

- Part II. Simple Moving Average

- Part III. Exponential Moving Average

- Part IV. Which one is better – EMA or SMA?

- Part V. Using Moving Averages. Displaced MA

- Part VI. Trading moving averages crossover

- Part VII. Dynamic support and resistance

- Part VIII. Summary of Moving Averages

-

Bollinger Bands

- Part I. Bollinger Bands

- Part II. Moving Average Convergence Divergence - MACD

- Part III. Parabolic SAR - Stop And Reversal

- Part IV. Stochastic

- Part V. Relative Strength Index

- Part VI. Detrended Oscillator and Momentum Indicator

- Part VII. Average Directional Move Index – ADX

- Part VIII. Indicators: Tightening All Together

- Leading and Lagging Indicators

- Basic chart patterns

- Pivot points – description and calculation

- Elliot Wave Theory

- Intro to Harmonic Patterns

- Divergence Intro

- Harmonic Approach to Recognizing a Trend Day

- Intro to Breakouts and Fakeouts

- Again about Fundamental Analysis

- Cross Pair – What the Beast is That?

- Multiple Time Frame Intro

- Market Sentiment and COT report

- Dealing with the News

- Let's Start with Carry

- Let’s Meet with Dollar Index

- Intermarket Analysis - Commodities

- Trading Plan Framework – Common Thoughts

- A Bit More About Personality

- Mechanical Trading System Intro

- Tracking Your Performance

- Risk Management Framework

- A Bit More About Leverage

- Why Do We Need Stop-Loss Orders?

- Scaling of Position

- Intramarket Correlations

- Some Talk About Brokers

- Forex Scam - Money Managers

- Graduation!