Part IV. How to apply all these lines in trading?

Commander in Pips: So, we’ve learned the basics of all these lines – support, resistance, trend lines and channel, now it’s time to talk about their application in practice…

Pipruit: At last – practice… This word makes my heart tremble with joy.

Commander in Pips: As we already know any line can provide either support or resistance initially. Hence there are only two major price behaviors are possible after it has reached the line – bouncing from it or breaking it. But first, memorize this very important notice:

Notice:

We strongly do not recommend that you use any line types as a single context for trading. You should use lines as an additional tool in an overall trading plan and trading context.

This will become clearer, when we will study all the other tools and provide an algorithm on how to create a trading plan and what parts it should contain. But currently just remember, that it is better not to make trades that are based only on lines.

Pipruit: Ok, thanks

Commander in Pips: So, as we’ve said market can pull back from the line or break it, so let’s take a look at these possibilities closely:

Pullback or Bounce

As you understand, this kind of scenario assumes that the line will not be broken and will hold the price action. But who knows this ahead of time? Yes, you see the line, and know about the price level, but will it hold or not? – nobody knows in advance. So, what do you prefer? – enter to the trade right from the line without knowing – will it hold or not, or wait some confirmation of strength?

Pipruit: I think to wait a confirmation is safer. But will the enter price for both scenarios be the same?

Commander in Pips: No, they will not. Confirmation suggests that you enter the trade after the bounce from the line with worse price, but with higher probability of profit.

Pipruit: Once we’ve pointed that trading should be made in terms of probability. The first entry – without confirmation reminds me of a slice & dice game, but entering after the bounce is a logical entry. Besides, the fact that I’ve entered with a bit worse price does not mean that I will take a loss. So, I choose the second way – after confirmation.

Commander in Pips: You’re absolutely right. Entering after confirmation is much safer and has more chances of success, than entering ahead of the market. Do not ever try to predict the market – wait for when the market itself will show you what it intends to do. There is a proverb – “it is unwise to run ahead of a train”. In this meaning entering before a confirmation is equal to catching the falling knife. And this is really more gambling than trading. Trading is a business – not a gamble.

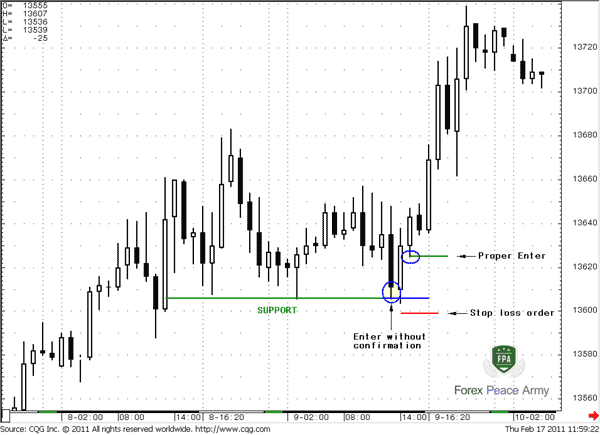

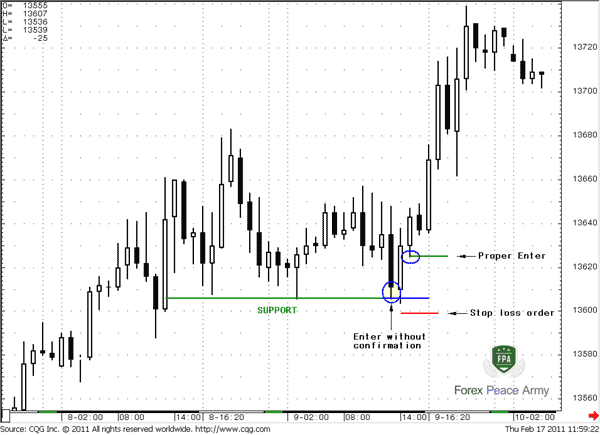

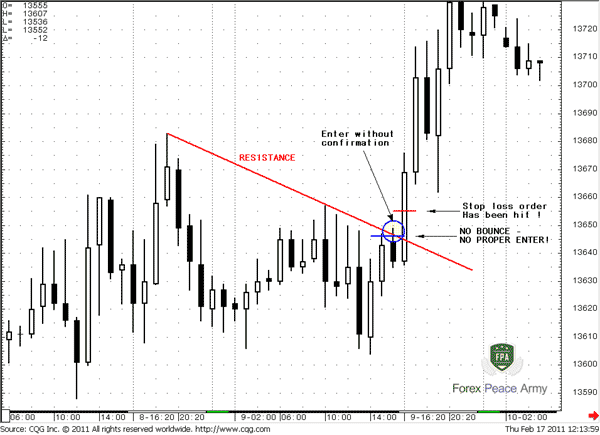

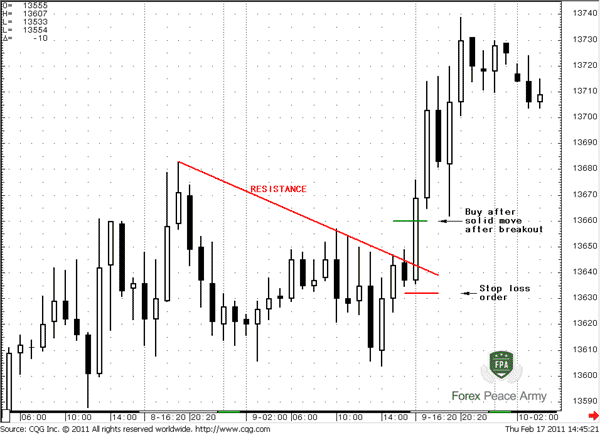

Take a look at the #1 chart – this is 60-min EUR/USD. Here we clearly see a support line, and let’s assume that we want to buy here. I’ve marked two ways of possible entering. The first way – is to enter without confirmation (short blue line) and the correct entry is the green line. The stop loss order is marked by red line. So, you can see that let’s call it as “gamble entry” has some advantage in price level, compared to “Proper entry” – but both positions will make profit from this trade.

Pipruit: Well, Commander, your speech is confusing me – once we’ve said that we should not enter without confirmation, and here you show that this position has advantages in price level – because “Gamble entry” got in at a lower price, hence the profit will be greater than from “Proper entry”.

#1 EUR/USD 60-min

Commander in Pips: Hold on, son – I’ll show you. Now take a look at the #2 chart. In fact, this is the same chart, but let suppose, that we intend to sell from resistance. See – “Gamble entry” has taken place and very quickly turns to loss, because the market has hit the stop-loss order. The “Proper entry” hasn’t taken place at all – there was no bouncing, i.e. confirmation of this trend line, so you just did not entered into this trade and saved your money!

Commander in Pips: And now just imagine these two ways of entering with multiple times – who do you think, who will gain more – a trader that uses “proper entry” or “gambling trader”?

Commander in Pips: Delighted!

Commander in Pips: Well, later we will learn more tools and how to use them to increase our confidence around support and resistance levels. Second – use the rules that we’ve discussed in previous chapters about different line types. Third – the probability of a breakout always exists. Remember this one – “The market is always right”. It means that although our tools are significantly increase our chances of success, still there could be failures and losses not because you’ve done something wrong, but because this is a probability. Losing trades is a part of this business.

A good trader is the person who makes less mistakes but not the person who never makes mistakes at all.

Ok, as a summary to our discussion of possible entry at bouncing we have to say:

The major task at of any trade – is to shift the probability in our favor. Second – always remember that trading is not gambling. If you do something – you have to have a context and logical basis to do it. No trade should ever be done for an adrenaline rush.

So, using the confirmation and “proper entry” after the bouncing is a tool of shifting the probability in our favor. The point is that the market itself shows us the strength of some line, with price bouncing from it. You should open a position after the bouncing – with this approach you avoid loss in numerous situations when the market falls like a stone and breaks the lines. If you will not follow to our advice – you can get really hurt by catching the falling knife.

Breakout of the Lines

As you understand nothing lasts forever, even lines. They have a tendency to be broken by the market price action… very often.

As you understand nothing lasts forever, even lines. They have a tendency to be broken by the market price action… very often.

So, here we will discuss how we can act in this scenario.

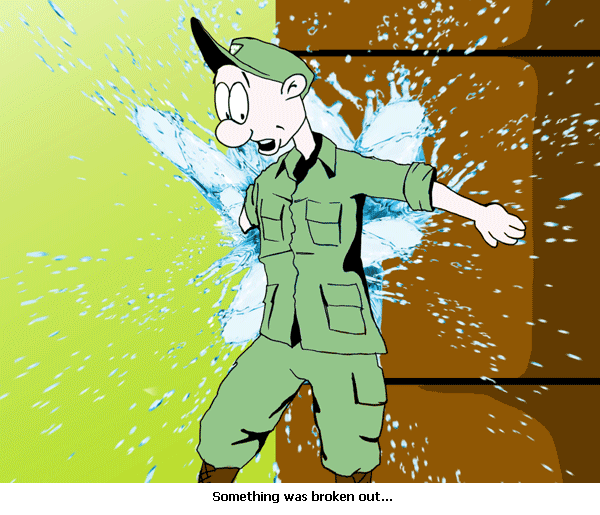

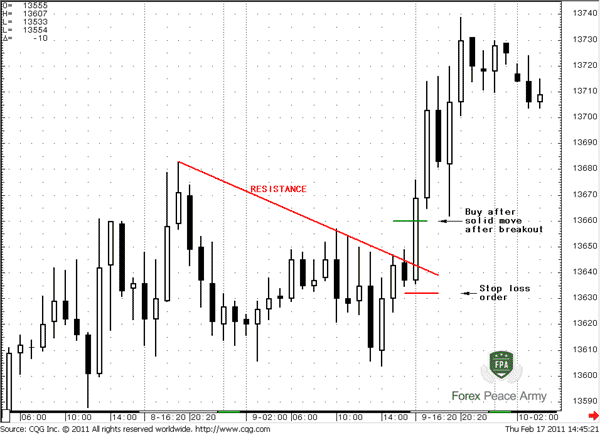

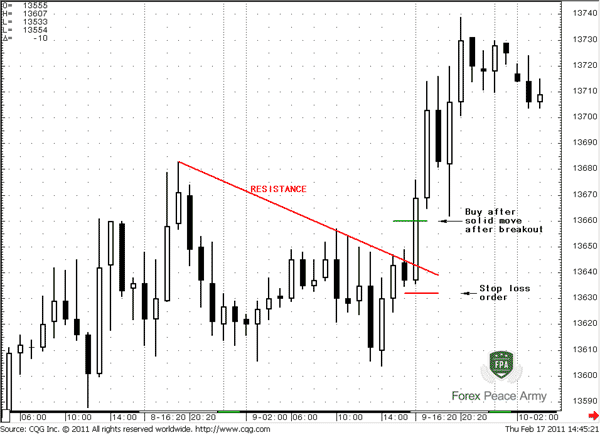

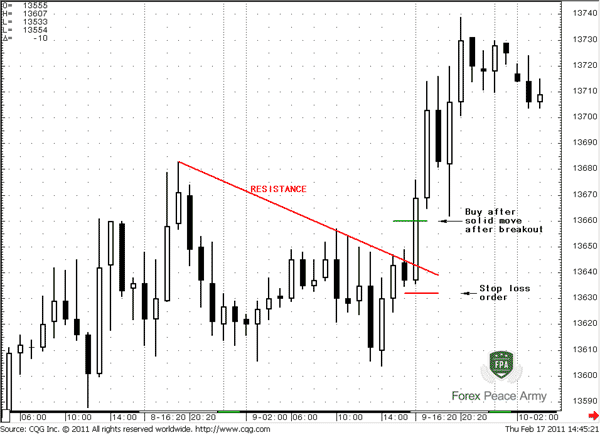

The first way to trade it is simply enter the market after a breakout when the price has moved through the level for a solid distance. Here is an example - this is the same chart as #2, but for our purpose here we want to buy if upper breakout of resistance line will take place:

Commander in Pips: Well a lot of blurring details, such as:

1. How much should be a “Solid move” after breakout?

2. When the market just explodes as on chart #3 – you will have to jump onto a running train. The stop order has been placed too far – this is a significant risk.

3. Remember what we’ve talked about Wash&Rinse patterns – in fact, failure breakouts happen much more often than real breakouts.

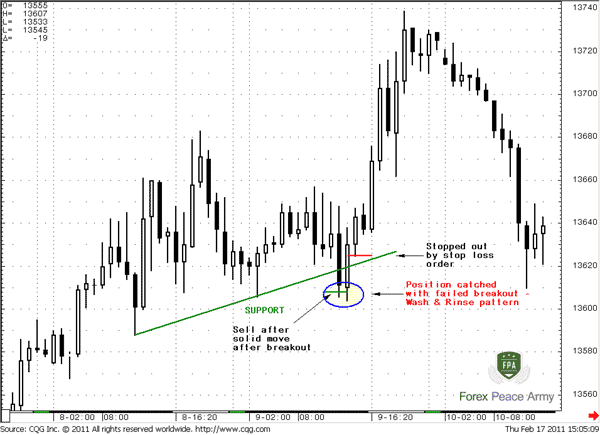

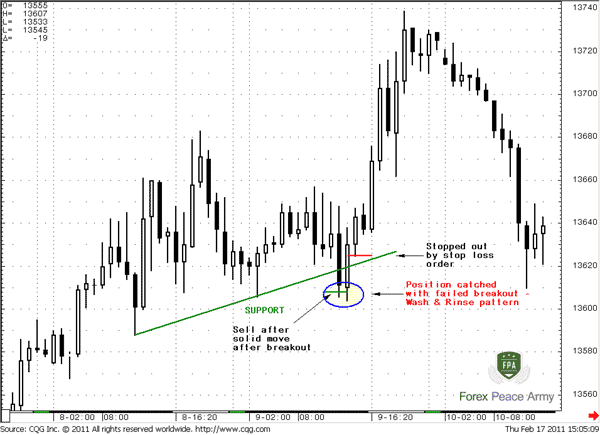

Take a look at chart #4 - you will understand it fast:

Commander in Pips: First of all, remember the rules of breaking support and resistance levels – application of close price and the 3-period rule. These rules are absolutely suitable for estimation of breakout reality.

Commander in Pips: Yes, second – as we said, appearing of a Wash & Rinse pattern tells us that the market is ready for move in the opposite direction. We should not sell here, but buy. W&R confirms the strength of the line! We’ve talked about it in detail in previous chapters.

Commander in Pips: Well, in fact you may. Some traders call this type of breakout trading as “Aggressive”, but we can’t agree with it. Because this type of breakout trading has not impressive probability to success and too far stop orders, that lead to much greater risk. This combination seems to us as “Not logical”, so our preferred way to trade the breakouts is the next one as on chart #5:

1. You do not need to guess about “solid move after breakout”

2. You have a confirmation from the market by failure to return right back above the line

3. You have a better opportunity to place your stop loss order and your stop loss order is tighter to significantly reduce risk.

4. Very often your entry level will be better compared to entering with the initial breakout (try to find entry level according to the first type entering – and you’ll see. Besides, there is a probability that with first type of entering your stop loss could be triggered precisely during the pullback. So you could be stopped out at the moment where you have to enter the trade and not to exit...)

5. All you need to succeed in this kind of trades – is a bit patience to wait the right moment to enter the market.

Commander in Pips: Yep, this is it! Also, here you can see how a support trend line becomes a resistance line after breakout…

Commander in Pips: Ok, what do you want – trade all trades that you can ever find or to make money?

Commander in Pips: So, what is the question then, son? If the risk is too much – just skip the trade and calm down – your money is still with you and you always can find another possibility to trade, but with better initial conditions.

Remember this excellent proverb by the famous trader Joe DiNapoli:

1. Again, we do not recommend to trade breakouts as on chart #3. If you will trade it in such manner still – do it only with stop loss order in place. A stop loss order is a must here. And strictly apply money management rules that we will learn later.

2. Our preferable way to trade breakouts is as on picture #5. Take a note, the market does not always behave like that – sometimes it can just run through the level without any pullback. So, here you have the chance of safer trades but with a risk to not be filled if market will not return back to the line. Other words, you can miss this trade, and it can happen very often.

3. But we think that this is OK, due to very good market philosophy: “Loss of opportunity is preferable to loss of capital!” Because you enter the market not just to trade, but to make profit.

4. Needless to say that here a stop loss order is also a must.

Commander in Pips: Hold on, son – I’ll show you. Now take a look at the #2 chart. In fact, this is the same chart, but let suppose, that we intend to sell from resistance. See – “Gamble entry” has taken place and very quickly turns to loss, because the market has hit the stop-loss order. The “Proper entry” hasn’t taken place at all – there was no bouncing, i.e. confirmation of this trend line, so you just did not entered into this trade and saved your money!

Pipruit: Cool stuff. I see.

Commander in Pips: And now just imagine these two ways of entering with multiple times – who do you think, who will gain more – a trader that uses “proper entry” or “gambling trader”?

Pipruit: Ok, I’ve got it, Sir. Now, I’m sure that I have to rely on “Proper entry” and “Gamble entry” will be beyond the law for me. Please hit my hands, if I’ll break this rule.

Commander in Pips: Delighted!

#2 EUR/USD 60-min

Pipruit: But only one question, Sir – even when we see the bounce and confirmation with close price after it, how we could be sure that this is a true bounce and that the market will not return to the downside again?

Commander in Pips: Well, later we will learn more tools and how to use them to increase our confidence around support and resistance levels. Second – use the rules that we’ve discussed in previous chapters about different line types. Third – the probability of a breakout always exists. Remember this one – “The market is always right”. It means that although our tools are significantly increase our chances of success, still there could be failures and losses not because you’ve done something wrong, but because this is a probability. Losing trades is a part of this business.

A good trader is the person who makes less mistakes but not the person who never makes mistakes at all.

Ok, as a summary to our discussion of possible entry at bouncing we have to say:

The major task at of any trade – is to shift the probability in our favor. Second – always remember that trading is not gambling. If you do something – you have to have a context and logical basis to do it. No trade should ever be done for an adrenaline rush.

So, using the confirmation and “proper entry” after the bouncing is a tool of shifting the probability in our favor. The point is that the market itself shows us the strength of some line, with price bouncing from it. You should open a position after the bouncing – with this approach you avoid loss in numerous situations when the market falls like a stone and breaks the lines. If you will not follow to our advice – you can get really hurt by catching the falling knife.

Breakout of the Lines

So, here we will discuss how we can act in this scenario.

The first way to trade it is simply enter the market after a breakout when the price has moved through the level for a solid distance. Here is an example - this is the same chart as #2, but for our purpose here we want to buy if upper breakout of resistance line will take place:

#3 EUR/USD 60-min

See – after the breakout, the market never returns back to the trend line and particular this trade has finished with a profit. Sometimes this happens, but this way of breakout trading is not our favorite one…

Pipruit: And what’s wrong with it?

Commander in Pips: Well a lot of blurring details, such as:

1. How much should be a “Solid move” after breakout?

2. When the market just explodes as on chart #3 – you will have to jump onto a running train. The stop order has been placed too far – this is a significant risk.

3. Remember what we’ve talked about Wash&Rinse patterns – in fact, failure breakouts happen much more often than real breakouts.

Take a look at chart #4 - you will understand it fast:

#4 EUR/USD 60-min

Pipruit: Ok, I’ve got it. So what we should to do then, how to trade breakouts?

Commander in Pips: First of all, remember the rules of breaking support and resistance levels – application of close price and the 3-period rule. These rules are absolutely suitable for estimation of breakout reality.

Pipruit: Yes, I think that will help. Applying the 3-period rule I do not enter the trade on chart #4, because the market shows only 1close below the trend line.

Commander in Pips: Yes, second – as we said, appearing of a Wash & Rinse pattern tells us that the market is ready for move in the opposite direction. We should not sell here, but buy. W&R confirms the strength of the line! We’ve talked about it in detail in previous chapters.

Pipruit: So, should I never trade breakouts in this way, or what?

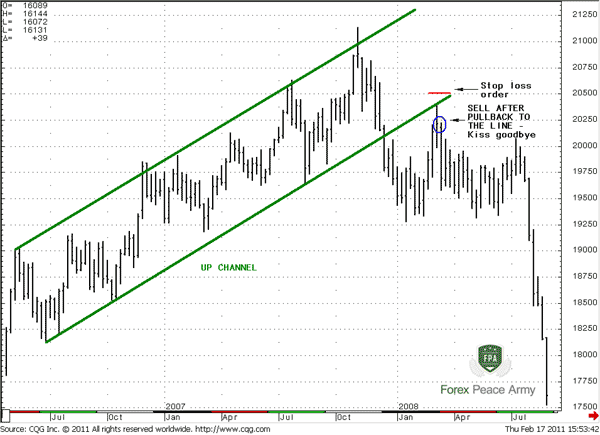

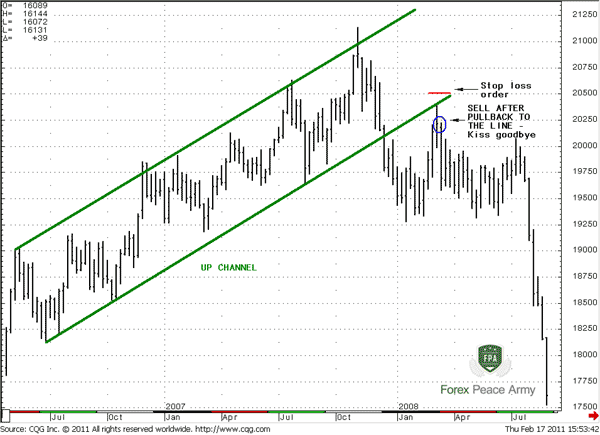

#5 GBP/USD Weekly

Here you can see how after the breakout, the market retests broken support of the up channel. When you see that the market confirms it failing to return right back (above the support) and capitulates – you enter short (i.e. Sell). Here you have some major advantages compared to the first way of breakout trading:

1. You do not need to guess about “solid move after breakout”

2. You have a confirmation from the market by failure to return right back above the line

3. You have a better opportunity to place your stop loss order and your stop loss order is tighter to significantly reduce risk.

4. Very often your entry level will be better compared to entering with the initial breakout (try to find entry level according to the first type entering – and you’ll see. Besides, there is a probability that with first type of entering your stop loss could be triggered precisely during the pullback. So you could be stopped out at the moment where you have to enter the trade and not to exit...)

5. All you need to succeed in this kind of trades – is a bit patience to wait the right moment to enter the market.

Pipruit: Looks like this is what you are named as “Kiss goodbye”?

Commander in Pips: Yep, this is it! Also, here you can see how a support trend line becomes a resistance line after breakout…

Pipruit: But, Commander, the market does not behave in such a way all the time. What will happen if it will not retest this line and just continue its move to the downside, like on chart #3?

#3 EUR/USD 60-min

Commander in Pips: You’re right in this case you will skip this trade – because you will not have an area and reason to enter. Definitely speaking, your entering order will not be filled, because the market will not reach it.

Pipruit: But I don’t want to skip trades!

Commander in Pips: Ok, what do you want – trade all trades that you can ever find or to make money?

Pipruit: Make money…

Commander in Pips: So, what is the question then, son? If the risk is too much – just skip the trade and calm down – your money is still with you and you always can find another possibility to trade, but with better initial conditions.

Remember this excellent proverb by the famous trader Joe DiNapoli:

“Loss of opportunity is preferable to loss of capital!”

Commander in Pips: Ok, as a summary to trading of breakouts I want to note follows things that are exceptionally important, to my mind:

1. Again, we do not recommend to trade breakouts as on chart #3. If you will trade it in such manner still – do it only with stop loss order in place. A stop loss order is a must here. And strictly apply money management rules that we will learn later.

2. Our preferable way to trade breakouts is as on picture #5. Take a note, the market does not always behave like that – sometimes it can just run through the level without any pullback. So, here you have the chance of safer trades but with a risk to not be filled if market will not return back to the line. Other words, you can miss this trade, and it can happen very often.

3. But we think that this is OK, due to very good market philosophy: “Loss of opportunity is preferable to loss of capital!” Because you enter the market not just to trade, but to make profit.

4. Needless to say that here a stop loss order is also a must.

Comments

I

Irena

12 years ago,

Registered user

Sive, I want to say "thank you" for your outstanding educational article and all your efforts here on Forex Peace Army! I have never seen such good and thorough explanation in any Forex educational materials and I have been (and paid for them!) through a good few. It is amazing that the best is actually free, and all I could say, again, is thank you so much!

:):):)

:):):)

M

mjunkyard

12 years ago,

Registered user

I have to second Irena. I've read so much on forex, this is the best!

G

georgeta

12 years ago,

Registered user

W&R

Hello Mr. Morten!

Very clear and tradable information on this lesson. Thank you!

Although I have some trouble recognising the W&R pattern when it happens, especialy on lower time frames like 15min. Is there any help that you can provide? Shall I be looking for a certain amount of pips to say that is a W&R or is more like an art form? Shall I enter imediately or wait for retracement? Where to put stops?

Thank you for sharing with us!

Hello Mr. Morten!

Very clear and tradable information on this lesson. Thank you!

Although I have some trouble recognising the W&R pattern when it happens, especialy on lower time frames like 15min. Is there any help that you can provide? Shall I be looking for a certain amount of pips to say that is a W&R or is more like an art form? Shall I enter imediately or wait for retracement? Where to put stops?

Thank you for sharing with us!

Sive Morten

12 years ago,

Registered user

> Hello Mr. Morten!

Very clear and tradable information on this lesson. Thank you!

Although I have some trouble recognising the W&R pattern when it happens, especialy on lower time frames like 15min. ..

Hi Georgeta,

Better to look at W&R in terms of time rather then in terms of pips. But compare it with the overall time frame. It should be fast return back, so that you can say that this was just a stop grabbing below the some level.

It is very dangerous to anticipate this pattern. You should wait till the close.

There are two possible ways to enter - right after the close of the bar. Or wait for some shallow retracement. Usually it is 0.382-0.5. Also you may enter twice, just to be sure that you will have at least half of position.

Stop could be placed right beyond the extreme of this pattern or, at least beyond 0.786 Fib level of it.

Sometimes market could show multiple W&R's especially on lower timeframes, such as 5-30 min charts. W&R is more reliable on higher time frames.

Anyway - track the nature of W&R first, and all other issues second. If you see some obvious level, then see it break and fast return back - very probable that this is W&R.

Sometimes it can look as single bar - hammer or spike. This is the same. In this case drop the time frame and look how fast there was a return back during this spike.

Very clear and tradable information on this lesson. Thank you!

Although I have some trouble recognising the W&R pattern when it happens, especialy on lower time frames like 15min. ..

Hi Georgeta,

Better to look at W&R in terms of time rather then in terms of pips. But compare it with the overall time frame. It should be fast return back, so that you can say that this was just a stop grabbing below the some level.

It is very dangerous to anticipate this pattern. You should wait till the close.

There are two possible ways to enter - right after the close of the bar. Or wait for some shallow retracement. Usually it is 0.382-0.5. Also you may enter twice, just to be sure that you will have at least half of position.

Stop could be placed right beyond the extreme of this pattern or, at least beyond 0.786 Fib level of it.

Sometimes market could show multiple W&R's especially on lower timeframes, such as 5-30 min charts. W&R is more reliable on higher time frames.

Anyway - track the nature of W&R first, and all other issues second. If you see some obvious level, then see it break and fast return back - very probable that this is W&R.

Sometimes it can look as single bar - hammer or spike. This is the same. In this case drop the time frame and look how fast there was a return back during this spike.

B

broc99

12 years ago,

Registered user

tnanks

I'd say even more. In addition to excelent content I have really grate pleasure with the language and the way of description. (I'm not an English native speaker and it's espesially important for me). Everything is clear and logically. Thank you ever so much :)

I'd say even more. In addition to excelent content I have really grate pleasure with the language and the way of description. (I'm not an English native speaker and it's espesially important for me). Everything is clear and logically. Thank you ever so much :)

G

georgeta

12 years ago,

Registered user

pure joy

Thank you Mr. Morten for the excellent information. It is more than I could expect.

Thank you Mr. Morten for the excellent information. It is more than I could expect.

H

haz

12 years ago,

Registered user

Thank you Guru

Great... Mr. Guru Morten. Thank you very much for your education that open my eyes, mind and heart. very useful for newb like me.

Great... Mr. Guru Morten. Thank you very much for your education that open my eyes, mind and heart. very useful for newb like me.

J

jimmy.wibisono

12 years ago,

Registered user

kiss goodbye

Hi sive, would you tell me more detailed about kiss goodbye ?

-Thank You-

Hi sive, would you tell me more detailed about kiss goodbye ?

-Thank You-

Sive Morten

12 years ago,

Registered user

> Hi sive, would you tell me more detailed about kiss goodbye ?

-Thank You-

Hi Jimmy,

It's a bit difficult to say "something" more detailed. ;)

This is just a simple retest of trendline from opposite side after breakout. Very often trend (MACD) holds in the direction of breakout even market shows retracement by "Kiss goodbye". Sometimes this retracement reaches some Fib retracement level that could coincide with trend line level. This gives more confidence with level.

-Thank You-

Hi Jimmy,

It's a bit difficult to say "something" more detailed. ;)

This is just a simple retest of trendline from opposite side after breakout. Very often trend (MACD) holds in the direction of breakout even market shows retracement by "Kiss goodbye". Sometimes this retracement reaches some Fib retracement level that could coincide with trend line level. This gives more confidence with level.

S

steves

12 years ago,

Registered user

Thank you Sive

Sive,

I have now been following your recommendations for many months now and I agree with many...THANK YOU.

Your insight combined with Joe's tools confirms something I have always assumed...that the market does move with an underlying sense of logic.

I have been trading for 6 or 7 years now and what I have learned from the two of you has give order to the markets for me. I look forward with anticipation everyday of the week for you analysis for the day and the week on the weekend.

If you ever decide to leave the army and go it alone at a cost (like Ashrafi) I will like many others be more that willing to pay for your analysis and inspirations. I think that your doing it for free is amazing and I hope and pray you are bless accordingly.

THANK YOU AGAIN SIR!!!

Sive,

I have now been following your recommendations for many months now and I agree with many...THANK YOU.

Your insight combined with Joe's tools confirms something I have always assumed...that the market does move with an underlying sense of logic.

I have been trading for 6 or 7 years now and what I have learned from the two of you has give order to the markets for me. I look forward with anticipation everyday of the week for you analysis for the day and the week on the weekend.

If you ever decide to leave the army and go it alone at a cost (like Ashrafi) I will like many others be more that willing to pay for your analysis and inspirations. I think that your doing it for free is amazing and I hope and pray you are bless accordingly.

THANK YOU AGAIN SIR!!!

Sive Morten

12 years ago,

Registered user

> Sive,

I have now been following your recommendations for many months now and I agree with many...THANK YOU.

Your insight combined with Joe's tools confirms something I have always assumed...that..

Hi Steves,

Actually, we should appoint your gratitude to FPA, because this is FPA's merit that this material is free, not mine.

I have now been following your recommendations for many months now and I agree with many...THANK YOU.

Your insight combined with Joe's tools confirms something I have always assumed...that..

Hi Steves,

Actually, we should appoint your gratitude to FPA, because this is FPA's merit that this material is free, not mine.

C

cheater

11 years ago,

Registered user

Hi Sive,

In chart #5, don't you enter after confirming 3 periods of close below trend line breakout? In what circumstances that we don't adhere to the 3 period rule?

In chart #5, don't you enter after confirming 3 periods of close below trend line breakout? In what circumstances that we don't adhere to the 3 period rule?

Sive Morten

11 years ago,

Registered user

> Hi Sive,

In chart #5, don't you enter after confirming 3 periods of close below trend line breakout? In what circumstances that we don't adhere to the 3 period rule?

Hi Cheater,

well, 3-period rule is mostly controlling issue. Say, you have some trading plan and take some trade. You should expect that market will start move in your favor. If this will not happen within 3 periods, then something is wrong.

So, 3-period rule needs to be applied after entry, but not before it.

In chart #5, don't you enter after confirming 3 periods of close below trend line breakout? In what circumstances that we don't adhere to the 3 period rule?

Hi Cheater,

well, 3-period rule is mostly controlling issue. Say, you have some trading plan and take some trade. You should expect that market will start move in your favor. If this will not happen within 3 periods, then something is wrong.

So, 3-period rule needs to be applied after entry, but not before it.

C

cheater

11 years ago,

Registered user

> Hi Cheater,

well, 3-period rule is mostly controlling issue. Say, you have some trading plan and take some trade. You should expect that market will start move in your favor. If this will not happen ..

ah got it. So as a rule of thumb, can i say that we should always wait for "kiss goodbye" before we enter our position otherwise we just stay by the sideline?

In chart #5, when that "Sell" entry was filled with "Stop" above resistance trendline, we don't really use 3-period rule to decide the entry, but rather using 3-period rule to confirm the trend breakout

My question is on what basis are we looking at that level to "Sell"? Is it just by "kiss goodbye" occurence + 1 candle close below the line at 20250? Wouldn't that be too simple to read?

well, 3-period rule is mostly controlling issue. Say, you have some trading plan and take some trade. You should expect that market will start move in your favor. If this will not happen ..

ah got it. So as a rule of thumb, can i say that we should always wait for "kiss goodbye" before we enter our position otherwise we just stay by the sideline?

In chart #5, when that "Sell" entry was filled with "Stop" above resistance trendline, we don't really use 3-period rule to decide the entry, but rather using 3-period rule to confirm the trend breakout

My question is on what basis are we looking at that level to "Sell"? Is it just by "kiss goodbye" occurence + 1 candle close below the line at 20250? Wouldn't that be too simple to read?

Sive Morten

11 years ago,

Registered user

> ah got it. So as a rule of thumb, can i say that we should always wait for "kiss goodbye" before we enter our position otherwise we just stay by the sideline?

In chart #5, when that "Sell" entry was ..

Not quite.

"Kiss goodbye" does not always appear on line breakout. This is just an example how it could be. You want structurize trading process too strictly. This is just impossible. That's not the rule of thumb. This is more as "if". If you'll see "Kiss goodbye", that give you more evidence. That's all. But price could not re-test broken line...

No, it's imossible to say - wait 1 candle after Kiss goodbye and enter. It could take different forms.

In chart #5, when that "Sell" entry was ..

Not quite.

"Kiss goodbye" does not always appear on line breakout. This is just an example how it could be. You want structurize trading process too strictly. This is just impossible. That's not the rule of thumb. This is more as "if". If you'll see "Kiss goodbye", that give you more evidence. That's all. But price could not re-test broken line...

No, it's imossible to say - wait 1 candle after Kiss goodbye and enter. It could take different forms.

C

cheater

11 years ago,

Registered user

> Not quite.

"Kiss goodbye" does not always appear on line breakout. This is just an example how it could be. You want structurize trading process too strictly. This is just impossible. That's not the ..

i see what you mean now. Thanks!

"Kiss goodbye" does not always appear on line breakout. This is just an example how it could be. You want structurize trading process too strictly. This is just impossible. That's not the ..

i see what you mean now. Thanks!

P

PatrykM

10 years ago,

Registered user

Hi,

I have 2 question.

1.Where are we should start draw S&R,trend and channel lines, from shadow or body? Why on chart #2,#3 and #4 support and resistance line have slope angle I thought S&R are always horizontal(or is this trend line just with inscription support and resistance?)?

2.Is exist any place in FPA website where can I place my analysis with lines on chart to judge by someone who have experience to say it s correct or not?

It s more than 2 questions but I feel a bit confused.

I have 2 question.

1.Where are we should start draw S&R,trend and channel lines, from shadow or body? Why on chart #2,#3 and #4 support and resistance line have slope angle I thought S&R are always horizontal(or is this trend line just with inscription support and resistance?)?

2.Is exist any place in FPA website where can I place my analysis with lines on chart to judge by someone who have experience to say it s correct or not?

It s more than 2 questions but I feel a bit confused.

P

phil7525

10 years ago,

Registered user

Everybody has left their thank-you's and I should too, just for you to share this wealth of info. with all of us.

This is one of the best, thank you!

This is one of the best, thank you!

Hamza Samiullah

7 years ago,

Registered user

Excellent ..

B

broc99

6 years ago,

Registered user

Hi Sive,

On the p.5 of the chapter you write:

Pipruit: Ok, I’ve got it. So what we should to do then, how to trade breakouts?

Commander in Pips: First of all, remember the rules of breaking support and resistance levels – application of close price and the 3-period rule. These rules are absolutely suitable for estimation of breakout reality.

Pipruit: Yes, I think that will help. Applying the 3-period rule I do not enter the trade on chart #4, because the market shows only 1close below the trend line.

Commander in Pips: Yes, second – as we said, appearing of a Wash & Rinse pattern tells us that the market is ready for move in the opposite direction. We should not sell here, but buy. W&R confirms the strength of the line! We’ve talked about it in detail in previous chapters.

On the other hand in the Q&A you explain about "3 period" rule

In chart #5, don't you enter after confirming 3 periods of close below trend line breakout? In what circumstances that we don't adhere to the 3 period rule?

Hi Cheater,

well, 3-period rule is mostly controlling issue. Say, you have some trading plan and take some trade. You should expect that market will start move in your favor. If this will not happen within 3 periods, then something is wrong.

So, 3-period rule needs to be applied after entry, but not before it.

Can you clarify this please? I mean should we wait for confirmation for 3 bars or we entered relying on something else but if the price doesn't stay beyond the broken line for 3 periods we are about to close the trade?

On the p.5 of the chapter you write:

Pipruit: Ok, I’ve got it. So what we should to do then, how to trade breakouts?

Commander in Pips: First of all, remember the rules of breaking support and resistance levels – application of close price and the 3-period rule. These rules are absolutely suitable for estimation of breakout reality.

Pipruit: Yes, I think that will help. Applying the 3-period rule I do not enter the trade on chart #4, because the market shows only 1close below the trend line.

Commander in Pips: Yes, second – as we said, appearing of a Wash & Rinse pattern tells us that the market is ready for move in the opposite direction. We should not sell here, but buy. W&R confirms the strength of the line! We’ve talked about it in detail in previous chapters.

On the other hand in the Q&A you explain about "3 period" rule

In chart #5, don't you enter after confirming 3 periods of close below trend line breakout? In what circumstances that we don't adhere to the 3 period rule?

Hi Cheater,

well, 3-period rule is mostly controlling issue. Say, you have some trading plan and take some trade. You should expect that market will start move in your favor. If this will not happen within 3 periods, then something is wrong.

So, 3-period rule needs to be applied after entry, but not before it.

Can you clarify this please? I mean should we wait for confirmation for 3 bars or we entered relying on something else but if the price doesn't stay beyond the broken line for 3 periods we are about to close the trade?

Table of Contents

- Introduction

- FOREX - What is it ?

- Why FOREX?

- The structure of the FOREX market

- Trading sessions

- Where does the money come from in FOREX?

- Different types of market analysis

- Chart types

- Support and Resistance

-

Candlesticks – what are they?

- Part I. Candlesticks – what are they?

- Part II. How to interpret different candlesticks?

- Part III. Simple but fundamental and important patterns

- Part IV. Single Candlestick Patterns

- Part V. Double Deuce – dual candlestick patterns

- Part VI. Triple candlestick patterns

- Part VII - Summary: Japanese Candlesticks and Patterns Sheet

-

Mysterious Fibonacci

- Part I. Mysterious Fibonacci

- Part II. Fibonacci Retracement

- Part III. Advanced talks on Fibonacci Retracement

- Part IV. Sometimes Mr. Fibonacci could fail...really

- Part V. Combination of Fibonacci levels with other lines

- Part VI. Combination of Fibonacci levels with candle patterns

- Part VII. Fibonacci Extensions

- Part VIII. Advanced view on Fibonacci Extensions

- Part IX. Using Fibonacci for placing orders

- Part X. Fibonacci Summary

-

Introduction to Moving Averages

- Part I. Introduction to Moving Averages

- Part II. Simple Moving Average

- Part III. Exponential Moving Average

- Part IV. Which one is better – EMA or SMA?

- Part V. Using Moving Averages. Displaced MA

- Part VI. Trading moving averages crossover

- Part VII. Dynamic support and resistance

- Part VIII. Summary of Moving Averages

-

Bollinger Bands

- Part I. Bollinger Bands

- Part II. Moving Average Convergence Divergence - MACD

- Part III. Parabolic SAR - Stop And Reversal

- Part IV. Stochastic

- Part V. Relative Strength Index

- Part VI. Detrended Oscillator and Momentum Indicator

- Part VII. Average Directional Move Index – ADX

- Part VIII. Indicators: Tightening All Together

- Leading and Lagging Indicators

- Basic chart patterns

- Pivot points – description and calculation

- Elliot Wave Theory

- Intro to Harmonic Patterns

- Divergence Intro

- Harmonic Approach to Recognizing a Trend Day

- Intro to Breakouts and Fakeouts

- Again about Fundamental Analysis

- Cross Pair – What the Beast is That?

- Multiple Time Frame Intro

- Market Sentiment and COT report

- Dealing with the News

- Let's Start with Carry

- Let’s Meet with Dollar Index

- Intermarket Analysis - Commodities

- Trading Plan Framework – Common Thoughts

- A Bit More About Personality

- Mechanical Trading System Intro

- Tracking Your Performance

- Risk Management Framework

- A Bit More About Leverage

- Why Do We Need Stop-Loss Orders?

- Scaling of Position

- Intramarket Correlations

- Some Talk About Brokers

- Forex Scam - Money Managers

- Graduation!