Part I. Different types of market analysis

Commander in Pips: Congratulations, son. You’ve passed through our Enlisted grade. Now you are entering in Noncommissioned Officers grade with FX Sergeant Level. You’ve learned much about Forex, how it works, what does it consist from, when it has appeared. You’ve investigated how to read quotes, calculate margin, pro… (interrupting)…fit…

Pipruit: Sir may be enough with that blah-blah-blah, or I will fall asleep before you’ll finish. You’ve promised that you will start to show me how to make money on Forex. I’ve borne all this stuff only thanks to hope that I will see something more than just some pages from history book.

Commander in Pips: Ok, son, you’ve just chose your poison – there will not be road back. You’ve decided to investigate dreadful and amazing FX market and try to turn it in stable source of profit. Just remember – the hard work, perpetual education process, practice and some painful losses and other unpleasant moments are awaiting you on this way. Or, you may finish with it – just return to ordinary job with fixed wage and work time, there will be no disappointments and hard work on this way. Choice is yours.

Pipruit: No way, Sir – I choose to continue with FX market.

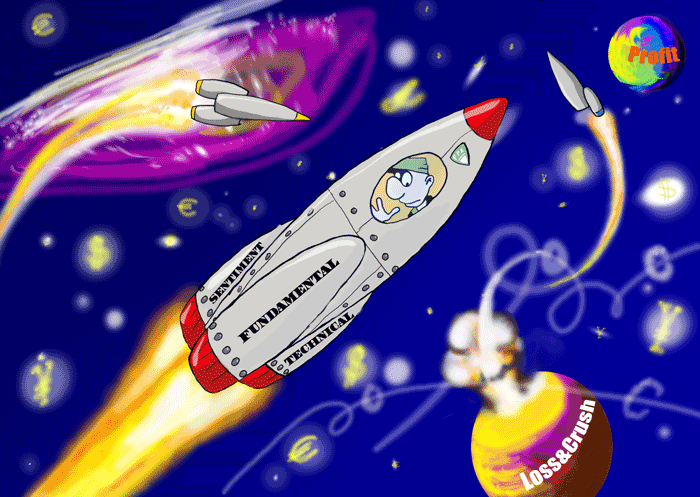

Commander in Pips: So be it. Let’s turn to the point then. Today I tell you about ways or types of market analysis. In fact the type of analysis means some way of judgment and assessment of market situation to make a decision about its perspectives. There are three well-known types of analysis:

1. Fundamental analysis

2. Technical analysis

3. Sentiment analysis

There are lot of arguments concerning what type of analysis is better. Although it will be perfect to have an excellent knowledge and practical skills for each type, but I will not state that it is absolutely necessary. Many market participants and authorities tell that it will be better if trader perfectly governs with all three ways of analysis. Well, it’s difficult to argue with this statement.

Commander in Pips: Theoretically – yes, but talking about real life - in general, depending on own tasks and trading way most traders make some particular type as primary and others types as supportive one. It assumes that trader should have perfect knowledge and application skills at least in single type of analysis and have a common knowledge with the others. But this common knowledge is absolutely necessary, because you should have at least general understanding of what is going on the market. I will be absolutely happy if you will become a master in all three types of analysis, but I suggest that you should start at least from one of them. And later you can calmly choose preferable type and decide – do you really need perfect level for all of them, or just for one and familiar with others.

Pipruit: I heard that technical analysis is simplest, may be I should choose this one and ignore the others?

Commander in Pips: I think that this is a way to financial catastrophe. You may choose technical analysis as primary one. But ignoring other types can lead you to wracking. Just imagine the situation – you have excellent skills in technical analysis, but you turn on the TV and see that Fed Chairman tells something about Fed rate perspective of US economy. Right after his words the market starting dooming and glooming. Or, for instance, you make a perfect technical analysis of the market and almost ready to open position but suddenly some important macro data has been released and market starts to accelerate in opposite direction to your expectations. If you do not understand why it has happened and what you should to do now - then your things are in a bad way. You may not use all three types of analysis in the same degree of intensity, but you have to be familiar with all of them at solid level of knowledge. Still the fact is that you will be able to make a reasonable choice only when you will finish our school. This is an awful truth.

Comments

Hamza Samiullah

7 years ago,

Registered user

Nice intro for analysis...

D

Dakeju

6 years ago,

Registered user

The momentum is building. Great stuff !!

G

greatufuo

4 years ago,

Registered user

Good day sir, pls what is market execution

Table of Contents

- Introduction

- FOREX - What is it ?

- Why FOREX?

- The structure of the FOREX market

- Trading sessions

- Where does the money come from in FOREX?

- Different types of market analysis

- Chart types

- Support and Resistance

-

Candlesticks – what are they?

- Part I. Candlesticks – what are they?

- Part II. How to interpret different candlesticks?

- Part III. Simple but fundamental and important patterns

- Part IV. Single Candlestick Patterns

- Part V. Double Deuce – dual candlestick patterns

- Part VI. Triple candlestick patterns

- Part VII - Summary: Japanese Candlesticks and Patterns Sheet

-

Mysterious Fibonacci

- Part I. Mysterious Fibonacci

- Part II. Fibonacci Retracement

- Part III. Advanced talks on Fibonacci Retracement

- Part IV. Sometimes Mr. Fibonacci could fail...really

- Part V. Combination of Fibonacci levels with other lines

- Part VI. Combination of Fibonacci levels with candle patterns

- Part VII. Fibonacci Extensions

- Part VIII. Advanced view on Fibonacci Extensions

- Part IX. Using Fibonacci for placing orders

- Part X. Fibonacci Summary

-

Introduction to Moving Averages

- Part I. Introduction to Moving Averages

- Part II. Simple Moving Average

- Part III. Exponential Moving Average

- Part IV. Which one is better – EMA or SMA?

- Part V. Using Moving Averages. Displaced MA

- Part VI. Trading moving averages crossover

- Part VII. Dynamic support and resistance

- Part VIII. Summary of Moving Averages

-

Bollinger Bands

- Part I. Bollinger Bands

- Part II. Moving Average Convergence Divergence - MACD

- Part III. Parabolic SAR - Stop And Reversal

- Part IV. Stochastic

- Part V. Relative Strength Index

- Part VI. Detrended Oscillator and Momentum Indicator

- Part VII. Average Directional Move Index – ADX

- Part VIII. Indicators: Tightening All Together

- Leading and Lagging Indicators

- Basic chart patterns

- Pivot points – description and calculation

- Elliot Wave Theory

- Intro to Harmonic Patterns

- Divergence Intro

- Harmonic Approach to Recognizing a Trend Day

- Intro to Breakouts and Fakeouts

- Again about Fundamental Analysis

- Cross Pair – What the Beast is That?

- Multiple Time Frame Intro

- Market Sentiment and COT report

- Dealing with the News

- Let's Start with Carry

- Let’s Meet with Dollar Index

- Intermarket Analysis - Commodities

- Trading Plan Framework – Common Thoughts

- A Bit More About Personality

- Mechanical Trading System Intro

- Tracking Your Performance

- Risk Management Framework

- A Bit More About Leverage

- Why Do We Need Stop-Loss Orders?

- Scaling of Position

- Intramarket Correlations

- Some Talk About Brokers

- Forex Scam - Money Managers

- Graduation!