Part II. What is a trading object in the FOREX market?

Commander in Pips: Ok, troops, who can answer me this one simple question?Pipruit: Well, we’ve just investigated that the FOREX is a money market, so I assume that the trading object of the market is MONEY.

Commander in Pips: That’s right son.

Pipruit: But I do not quite understand one thing. The point is that if we want to buy something, we should pay money for it. And here, on FOREX, we should pay money for purchasing the same money. I’m confused a bit.

Commander in Pips: Well, I’ll try to help you. You just have said: “we should pay money for purchasing the same money”. But this is not quite correct. You pay money, yes, but purchasing not the same but different money.

Pipruit: Hmm…

Commander in Pips: You never buy on the FOREX market US dollars for US dollars, because this transaction makes no sense. It’s the same like you come to your fellow once and tell him – say, let’s change – I’ll give you 5 bucks for your 5 bucks. He may think that you’ve gone nuts. But if your friend has some different money, like Japanese Yen left over from his recent trip to Japan, this will be quite different story…

Pipruit: Oh! I think I’ve got it. It makes sense to trade currency of different countries with each other, but not a currency with itself, because the exchange rate of a currency with itself never changes.

Commander in Pips: Right you are.

Pipruit: But what is the economic basis for this, why are rates changing all the time?

Commander in Pips: Well, as you know, currency is the blood of the national economy of a country. It means that the rate of currency relative to other currencies depends on the fiscal health and perspectives of each country. This fact explains why currencies rates fluctuate all the time.

Commander in Pips: If, for example, you see that EU economy does not show growth and looks like it is bad and getting worse, but Japan’s economy is behaving well and is improving- it seems logical to buy Yen for Euros. In fact, all positive and negative national issues, not only economic but also a political, find their way into the currency value. Furthermore, not only those that have happened already, but those that were announced or are expected to happen in the future by market participants.

Pipruit: Sounds like buying equities. But instead of different companies these are different national economies, and instead of stocks these are currencies. It seems that when I’m buying one or another currency, I’m buying a share in the national economy that this currency belongs to.

Commander in Pips: “Buying a share in the national economy that this currency belongs to.” Nice conclusion, son, even I couldn’t say it better. Absolutely right!

Pipruit: I think I’m starting to understand the concept. The last question…When we choose equity to purchase, we have confidence or assume, at least, that this equity and their company will perform better than their rivals. It’s absolutely clear. But what is about currencies?

Commander in Pips: Absolutely the same. For example, when you’re buying Yen for US dollars, you expect that the Japanese economy will outperform US economy during the time while you intend to hold Yen position. If you are right, then you will exchange Yen for bucks after some time and make some profit, because yen rate will become higher and you will get more US dollars for the same amount of Yen during reverse exchange – when you sell the Yen for dollars. Generally speaking, the exchange rate of one currency to another reflects the relative power, condition and perspectives of that country’s economy, compared to other one.

Pipruit: Ok, I’ve got it! It’s not so complicated like it seemed in the beginning. And what particular currencies are traded on FOREX?

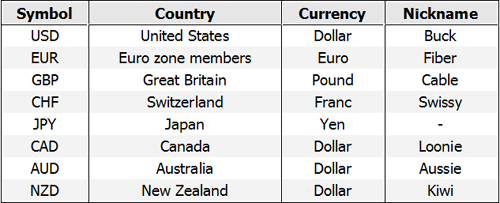

Commander in Pips: Most of the currencies in the world are traded. That’s too big to get into nopw. Let’s say I specify the major ones first. They are EUR, USD, NZD, JPY, CHF, GBP, CAD, and AUD…

Pipruit: Hold on, hold on… Let’s say I’ve guessed that USD is “US Dollar”, but what are some others?

Commander in Pips: Ok, the question is accepted. Let’s me explain the name system. All pairs have three-letter names. First two letters mark the country, and the third letter marks currency. So, for example – GBP, “GB” stands for Great Britain, “P” – stands for Pounds.

Pipruit: Cool, now let me guess, that “CA” means Canada, and D means Dollar.

Pipruit: Thanks, but let me one more question, Chief. Once I’ve heard how a FOREX trader was screaming on the phone “Buying cable, buying cable!” But cable looks like a commodity rather than a currency and we’ve just come to conclusion that FOREX is a money market.

Commander in Pips: This is simpler than you think. The point is that some currencies also have nicknames and Cable is a nickname of the GBP. Ok, I’ll also add some of the common nicknames into the table.

Comments

L

luciademoja

10 years ago,

Registered user

Hej, it's me again :)

This lesson was even more enlightening than the first one! Now I understand why USD is called "Buck" :D

The only thing that I didn't get it's the concept of "equity", it's a little bit confusing for me! I'll go ahead with the other parts of Chapter 1 hoping to find an answer, but in the meantime I'll try to ask around something.

It's hard to find out why if FOREX it's so easy it seems like no one do it! From yesterday I read a lot about FOREX in many forums and guides and all of them keep saying the same thing: you will make big money with low efforts! I don't know if I want to believe it, it smells like a big fake!

Do you think that is better to buy some course and start trying some system sooner that I thought?

Is there some dedicated area in this forum where I can do this kind of questions without being off topic? I have so many things to ask and I'll like to hear the answer from someone who talks about his personal experience! I'm walking through this jungle called "trading" and I'm a little scared about all the reassurance that I read about it in the sundry forums.

By the way, thank you for posting this guide, it's very helpful and I hope it will be a valid base for me!

I'm moving to the next part of the Chapter 1 now, see you!

This lesson was even more enlightening than the first one! Now I understand why USD is called "Buck" :D

The only thing that I didn't get it's the concept of "equity", it's a little bit confusing for me! I'll go ahead with the other parts of Chapter 1 hoping to find an answer, but in the meantime I'll try to ask around something.

It's hard to find out why if FOREX it's so easy it seems like no one do it! From yesterday I read a lot about FOREX in many forums and guides and all of them keep saying the same thing: you will make big money with low efforts! I don't know if I want to believe it, it smells like a big fake!

Do you think that is better to buy some course and start trying some system sooner that I thought?

Is there some dedicated area in this forum where I can do this kind of questions without being off topic? I have so many things to ask and I'll like to hear the answer from someone who talks about his personal experience! I'm walking through this jungle called "trading" and I'm a little scared about all the reassurance that I read about it in the sundry forums.

By the way, thank you for posting this guide, it's very helpful and I hope it will be a valid base for me!

I'm moving to the next part of the Chapter 1 now, see you!

A

Awoeyo GBENGA

10 years ago,

Registered user

"If, for example, you see that EU economy does not show growth and looks like it is bad and getting worse, but Japan’s economy is behaving well and is improving- it seems logical to buy Yen for Euros."

With the statement above,trading currency pair,EUR/JPY,which button is to be clicked on by the trader(BUY or SELL) on the broker's platform to act on the quoted statement?

Kindly help me with answer to this question as I am always confused.

With the statement above,trading currency pair,EUR/JPY,which button is to be clicked on by the trader(BUY or SELL) on the broker's platform to act on the quoted statement?

Kindly help me with answer to this question as I am always confused.

Sive Morten

10 years ago,

Registered user

> Hej, it's me again :)

This lesson was even more enlightening than the first one! Now I understand why USD is called "Buck" :D

The only thing that I didn't get it's the concept of "equity", it's a lit..

Hi,

many things that you're talking about are true. We've specified right in the beginning that only 2-5% makes money. Of cause there are a lot of, lets call it "authorities" that use and offer different tools and procedures that are not forbidden legally, but they are pitfall from probability point of view. Very simple example - huge leverage at small account. But there are more complicated issues exist. From that point of view Forex could be treated as a big fake, but only for those who do not have habit to work, be diligent and dicipline. For others chance exist. It's just impossible to describe so big topic in small post. You may read topics, closer to the end of the course, dedicated to forex scam, managing your trading - journaling, treating it as business, leverage topic, and some others.

> "If, for example, you see that EU economy does not show growth and looks like it is bad and getting worse, but Japan’s economy is behaving well and is improving- it seems logical to buy Yen for Euro..

Awoeyo, do not run ahead of train. If you do not know what button to press in this situation, may be you need a bit more knowledge before trading? If you will be a bit patient, you'll find very very detail answer in next chapters. ;)

This lesson was even more enlightening than the first one! Now I understand why USD is called "Buck" :D

The only thing that I didn't get it's the concept of "equity", it's a lit..

Hi,

many things that you're talking about are true. We've specified right in the beginning that only 2-5% makes money. Of cause there are a lot of, lets call it "authorities" that use and offer different tools and procedures that are not forbidden legally, but they are pitfall from probability point of view. Very simple example - huge leverage at small account. But there are more complicated issues exist. From that point of view Forex could be treated as a big fake, but only for those who do not have habit to work, be diligent and dicipline. For others chance exist. It's just impossible to describe so big topic in small post. You may read topics, closer to the end of the course, dedicated to forex scam, managing your trading - journaling, treating it as business, leverage topic, and some others.

> "If, for example, you see that EU economy does not show growth and looks like it is bad and getting worse, but Japan’s economy is behaving well and is improving- it seems logical to buy Yen for Euro..

Awoeyo, do not run ahead of train. If you do not know what button to press in this situation, may be you need a bit more knowledge before trading? If you will be a bit patient, you'll find very very detail answer in next chapters. ;)

B

Billy Pidu

8 years ago,

Registered user

FPA & Sive, thank you for the 4 pages of very helpful information on the trading object in the forex market. Wasn't clear at all to me until now. Much appreciated.

S

szerencsi.zsolt

7 years ago,

Registered user

Thanks your resume Sive.

Hamza Samiullah

7 years ago,

Registered user

Nice effort sive ... Greate..

somebody with gun

7 years ago,

Registered user

Thanks for the explanations and for the funny pictures))

Kenneth Norton

6 years ago,

Registered user

Thank you for this primer. I am new to FOREX but very excited to learn. One question, why is the Swiss Frank CHF and not SWF?

Anthony23

6 years ago,

Registered user

Haha)) Yes, an informative dialogue it's been actually. I even got a kick out of it=)

ardi23

6 years ago,

Registered user

like a stories

I'm love it...

I'm love it...

G

gottacoin62

6 years ago,

Registered user

cool! currency nicknames :)

A

Amandaknight02

5 years ago,

Registered user

Intrigued...

R

Royk_47

5 years ago,

Registered user

people comes with different ideas and a lots of questions..but i hope both we will understand Fx

F

fxtrendtrader

4 years ago,

Registered user

hehe, nice lesson, simple and easy to understand, thanks

A

Adan Martinez Rocha

3 years ago,

Registered user

Coming back after giving up trading 10+ years ago. It is great seeing what has happened to this site since, thank you Sive for sharing the knowledge. Going to the basics again and this is great!

W

Watswats

3 years ago,

Registered user

The training is Simplified and advancing. Thank you

calesobo

3 years ago,

Registered user

So far so good.I was here in 2017and I am back to refresh my memory.I would like to know if you have this course in a form that can be downloaded?I will be happy to download it.

AsstModerator

3 years ago,

Registered user

The FPA's operations rely heavily on showing banner ads. If we made the free material here available for download, we'd lose large amounts of income and not be able to afford to maintain the site.

C

clserve

3 years ago,

Registered user

Enjoying this course so far! i like the conversational style and funny pictures as well as the easy to understand language. Thank you.

R

RuthK

6 months ago,

Registered user

OMG...SO AWESOME!!! I FINALLY UNDERSTAND!!

Table of Contents

- Introduction

- FOREX - What is it ?

- Why FOREX?

- The structure of the FOREX market

- Trading sessions

- Where does the money come from in FOREX?

- Different types of market analysis

- Chart types

- Support and Resistance

-

Candlesticks – what are they?

- Part I. Candlesticks – what are they?

- Part II. How to interpret different candlesticks?

- Part III. Simple but fundamental and important patterns

- Part IV. Single Candlestick Patterns

- Part V. Double Deuce – dual candlestick patterns

- Part VI. Triple candlestick patterns

- Part VII - Summary: Japanese Candlesticks and Patterns Sheet

-

Mysterious Fibonacci

- Part I. Mysterious Fibonacci

- Part II. Fibonacci Retracement

- Part III. Advanced talks on Fibonacci Retracement

- Part IV. Sometimes Mr. Fibonacci could fail...really

- Part V. Combination of Fibonacci levels with other lines

- Part VI. Combination of Fibonacci levels with candle patterns

- Part VII. Fibonacci Extensions

- Part VIII. Advanced view on Fibonacci Extensions

- Part IX. Using Fibonacci for placing orders

- Part X. Fibonacci Summary

-

Introduction to Moving Averages

- Part I. Introduction to Moving Averages

- Part II. Simple Moving Average

- Part III. Exponential Moving Average

- Part IV. Which one is better – EMA or SMA?

- Part V. Using Moving Averages. Displaced MA

- Part VI. Trading moving averages crossover

- Part VII. Dynamic support and resistance

- Part VIII. Summary of Moving Averages

-

Bollinger Bands

- Part I. Bollinger Bands

- Part II. Moving Average Convergence Divergence - MACD

- Part III. Parabolic SAR - Stop And Reversal

- Part IV. Stochastic

- Part V. Relative Strength Index

- Part VI. Detrended Oscillator and Momentum Indicator

- Part VII. Average Directional Move Index – ADX

- Part VIII. Indicators: Tightening All Together

- Leading and Lagging Indicators

- Basic chart patterns

- Pivot points – description and calculation

- Elliot Wave Theory

- Intro to Harmonic Patterns

- Divergence Intro

- Harmonic Approach to Recognizing a Trend Day

- Intro to Breakouts and Fakeouts

- Again about Fundamental Analysis

- Cross Pair – What the Beast is That?

- Multiple Time Frame Intro

- Market Sentiment and COT report

- Dealing with the News

- Let's Start with Carry

- Let’s Meet with Dollar Index

- Intermarket Analysis - Commodities

- Trading Plan Framework – Common Thoughts

- A Bit More About Personality

- Mechanical Trading System Intro

- Tracking Your Performance

- Risk Management Framework

- A Bit More About Leverage

- Why Do We Need Stop-Loss Orders?

- Scaling of Position

- Intramarket Correlations

- Some Talk About Brokers

- Forex Scam - Money Managers

- Graduation!